For the first time in over two decades, Mexico has eclipsed China to become the leading single nation source of imports to the United States. This significant change in trade dynamics is attributed to the escalating diplomatic and trade tensions between Washington and Beijing, alongside concerted efforts by U.S. companies to diversify their supply chains toward nations that are both geopolitically aligned with the U.S. and geographically closer.

According to data from the U.S. Commerce Department released on Wednesday, imports from Mexico to the United States increased nearly 5% from 2022 to 2023, reaching over $475 billion. Meanwhile, imports from China saw a 20% decline to $427 billion, marking a notable shift from the last precedence of Mexican imports surpassing Chinese in 2002.

The deterioration of U.S.-China economic relations has been marked by aggressive trade disputes and military tensions initiated during the Trump administration and continued under President Joe Biden. Both administrations have imposed tariffs on Chinese goods, citing violations of global trade rules by Beijing.

In response to these challenges, the Biden administration has advocated for “friend-shoring” to allied countries, “reshoring” manufacturing back to the U.S., and “near-shoring” to countries in close proximity as strategies to reduce dependency on Chinese manufacturing. Mexico has emerged as a key beneficiary of this strategic pivot, with U.S. corporations increasingly looking to Mexican factories for their supply chains.

However, the transition is complex, with some Chinese manufacturers setting up operations in Mexico to leverage the U.S.-Mexico-Canada Trade Agreement’s duty-free trade benefits. This move underscores the intricate nature of global supply chains and the evolving landscape of international trade.

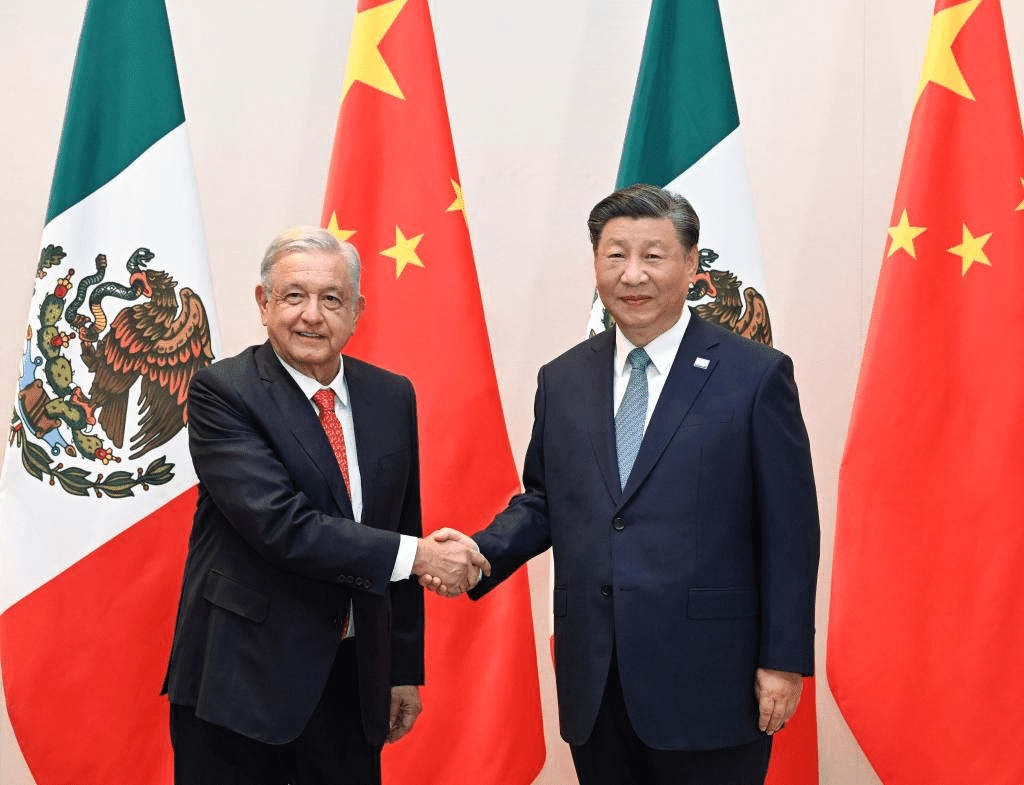

Mexican President Andrés Manuel López Obrador highlighted Mexico’s newfound trade leverage, noting the potential impact on U.S. immigration policy discussions and border control measures.

The shift has particular significance for certain industries, such as automotive manufacturing, which relies on cross-border supply chains between the U.S. and Mexico. Derek Scissors, a China specialist at the American Enterprise Institute, pointed out that the most significant declines in Chinese imports were in politically sensitive categories such as computers, electronics, and pharmaceuticals. Scissors anticipates that the reversal in import sources from China to Mexico is likely to persist beyond a single year, reflecting a broader wariness of China’s economic policies under President Xi Jinping.

The overall U.S. trade deficit decreased by 10% last year to $1.06 trillion, signaling a broader realignment of trade relationships and sourcing strategies by American companies. This shift in trade patterns not only reflects the geopolitical tensions between the U.S. and China but also highlights the strategic importance of Mexico in the North American economy.